About Us

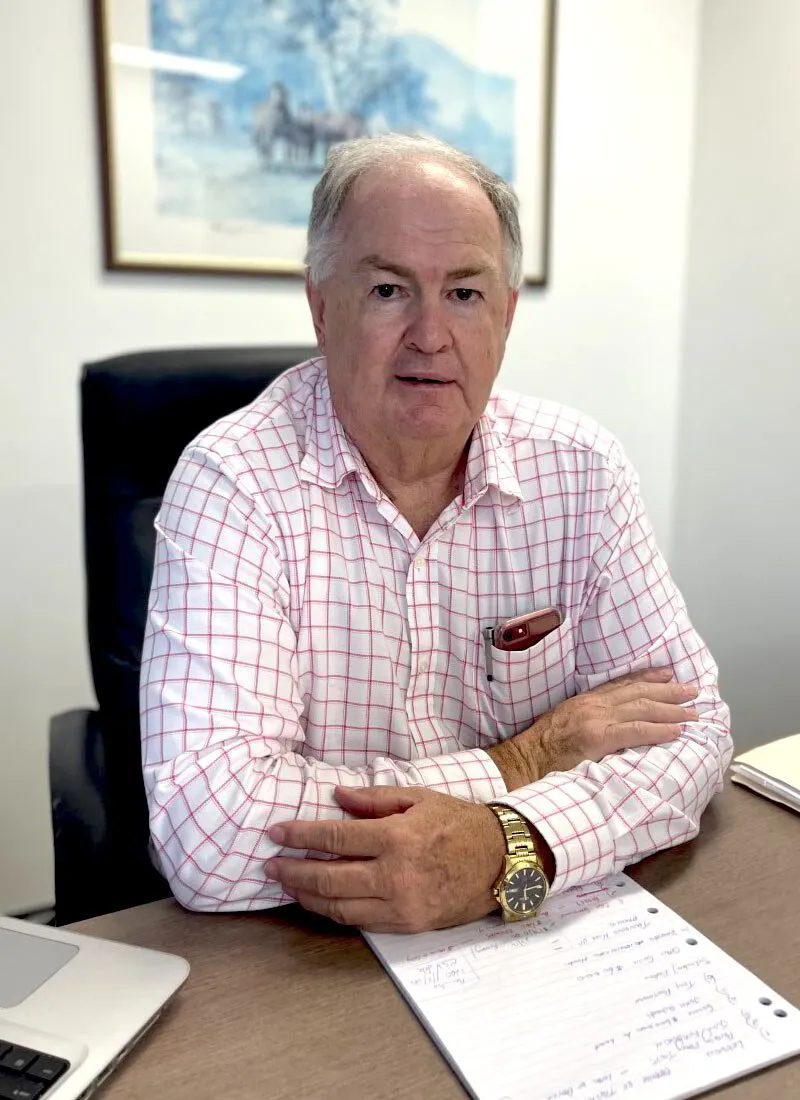

David Watkins

SMSF SPECIALIST ADVISORTM, CFP, Dpl. Fin Planning

With over 30 years of experience in Financial Planning, David has offered his expertise to a wide range of investors and now works with larger wholesale and experienced investor. An invaluable asset within the industry, he is a founding member of both The Association of Independent Financial Planners and Self-Managed Super Fund Association (SMSF), as well as being an active participant in the talk back radio circuit for financial segments. Furthering this commitment to providing sound advice about finances, David maintains membership with the respected Financial Planning Association (FPA).

David in the early 90’s recognised the need for specialised SMSF advice and was one a limited number of advisers to offer this advice. He is a SMSF Specialist advisor and continues to offer this advice.

Outside of work David spends most of his spare time on the family’s Rural Property where they breed Cattle and Thoroughbred horses.

Thomas Jacks

BCom (Acc), SMSF SpecialistTM, Adv. Dip F.S. (FP)

Thomas has been working in the financial services industry since 2007 and has been a licenced Financial Adviser since 2012. Thomas has vast experience in Financial Services and dealing with Self Managed Super Funds (SMSFs). He studied a Bachelor of Commerce at the University of Queensland, majoring in accounting. On completion of his degree, Thomas decided to move into the financial services industry as he wanted to help people gain more control over their investments and retirement savings. He saw a need to make sure clients are getting the appropriate advice and takes pride in educating his clients to provide them with financial security and peace of mind. He is a passionate Rugby Union fan and follows the QLD Reds.

Thomas is a member of the SMSF Association. He has undertaken testing of his SMSF knowledge and regulatory requirements as well as being assessed on ethical practices to ensure best standards are adhered to. Thomas has earned the qualification of an SMSF Specialist™ and is committed to maintaining his competence and expertise through ongoing professional development.

Maria Snegovaya

BBus(Fin), LLB(Hons), GradDipBus(FP), SMSF Specialist Advisor™

Maria entered the financial advice industry in 2019 and achieved her licence as a Financial Adviser in 2023. While studying her Bachelor of Business and Laws at Queensland University of Technology, with a major in finance, she discovered her true calling in financial advice. Her journey began with a role at a financial advisory firm, where she developed a passion for assisting individuals in harnessing the full potential of their finances.

Motivated by a strong commitment to financial empowerment, Maria strives to simplify complex financial concepts, enabling people to make informed decisions about their financial future. She dedicates herself to helping clients reach their financial goals while prioritising transparency, trust, and tailored solutions. Beyond her professional pursuits, Maria enjoys fine dining and travel.

Maria's expertise spans the spectrum of comprehensive financial planning, from holistic retirement strategies to investment management and risk assessment. With a particular interest in superannuation advice, including SMSFs, she is an active member of the SMSF Association. As an accredited SMSF Specialist Advisor (SSA®), she is committed to ongoing professional development.

Start your tomorrow planning today, ask us how to get started

We welcome your enquiry whether that be a simple question about our services, or how you can move forward with us for better results for future you.